hotel tax calculator nc

Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a. NA tax not levied on accommodations.

Your Tax Assessment Vs Property Tax What S The Difference

What is the sales tax rate in Fayetteville North Carolina.

. This is the total of state county and city sales tax rates. For tax year 2021 all taxpayers pay a flat rate of 525. Convention hotels located within a qualified local.

The minimum combined 2022 sales tax rate for Fayetteville North Carolina is. You might also encounter this tax as hotel lodging tax tourist tax room tax or sales tax. PO Box 25000 Raleigh NC 27640-0640.

So if the room costs 169 before tax at a rate of 0055 your hotel tax will add 169 x 0055 9295 or an extra 930 per night. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. 20 or more but less than 30.

The individual income tax estimator helps taxpayers estimate their North Carolina individual income tax liability. This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax. The County sales tax rate is.

The state hotel occupancy tax rate is 6 percent 06 of the cost of a room. Total Price is the final amount paid including sales tax. For State Use and Local Taxes use State and Local Sales Tax Calculator.

Your tax per night would be 1950. The North Carolina sales tax rate is currently. North Carolina moved to a flat income tax beginning with tax year 2014.

On or before March 31 2021 an accommodation facilitator must file an annual report for its accommodation. Connecting communities to funding sources to help build capacity and encourage economic development. A hotel occupancy tax is a tax placed on each nights stay at a hotel.

Community Economic Development. State and local governments throughout the United States are losing roughly 275 million to 400 million in revenue each year because of their failure to ensure that online travel companies like Expedia Orbitz and Priceline collect and remit the appropriate amount of tax on hotel room bookings. Im not sure about that particular hotel but the last time I stayed in Raleigh in November 10 I had to pay NC sales tax 775 Occupancy tax 3 and city tax 3.

The Room Occupancy Tax of 1991 is six percent 6 and the Room Occupancy Tax of 2006 is two percent 2 of the monthly gross receipts from the rental of any room lodging or accommodations furnished by a hotel motel inn tourist camp corporate housing or similar place. To get the hotel tax rate a percentage divide the tax per night by the cost of the room before taxes. Hotel-Motel Excise Tax Rates As of December 2021 Local Government Assistance.

50 cents per day per room the hotel room occupancy tax rate. The Room Occupancy Tax of 2006 must be charged separately and must be shown. 7 state sales tax plus 6 state hotel tax 13 if renting a hotel or room.

54 rows 125. 30 or more but less than 40. Net Price is the tag price or list price before any sales taxes are applied.

7 state sales tax plus 1 state hotel tax 8 if renting a whole house. Property management companies online travel companies and other third-party rental companies may also be responsible for collecting the tax. North Carolina Department of Revenue.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Cities and certain counties and special purpose districts are authorized to impose an additional local hotel tax that the local taxing authority collects. It is my understanding that in Raleigh lodging rooms are taxed at 135 475 state sales tax 225 county sales tax 6 county occupancy tax.

The Fayetteville sales tax rate is. So unless something has changed plan on 1375 total tax towards your room fee. 150 per day per room the hotel room occupancy tax rate.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. To get the rate divide 195 by 115 which equals 1696. 100 per day per room the hotel room occupancy tax rate.

Lodging is subject to state sales tax and state hotel tax. Sales Tax Amount Net Price x Sales Tax Percentage 100 Total Price Net Price Sales Tax Amount. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Including State Tax Occupancy Tax and County Sales Tax 11. This can make filing state taxes in the state relatively simple as even if your. But instead of increasing taxes on local residents property taxes for example state and local.

No additional local tax on accommodations. The hotel tax rate in Charlotte NC is 1625This breaks down to 525 state tax 3 local tax and an additional 8 for hotels. Hotel Taxes in North Carolina.

North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status. For example the total cost of a nights stay is 13450 with the rooms pre-tax cost at 115. Multiply the answer by 100 to get the rate.

1 State lodging tax rate raised to 50 in mountain lakes area. Gross receipts derived from the rental of an accommodation and the sales and use tax thereon are to be reported to the Department on Form E-500 Sales and Use Tax Return or through the Departments online filing and payment system. The North Carolina Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and North Carolina State Income Tax Rates and Thresholds in 2022.

That rate applies to taxable income which is income minus all qualifying deductions and exemptions as well as any contributions to a retirement plan like a 401k or an IRA. Overview of North Carolina Taxes. Rentals of an entire home are taxed at 8.

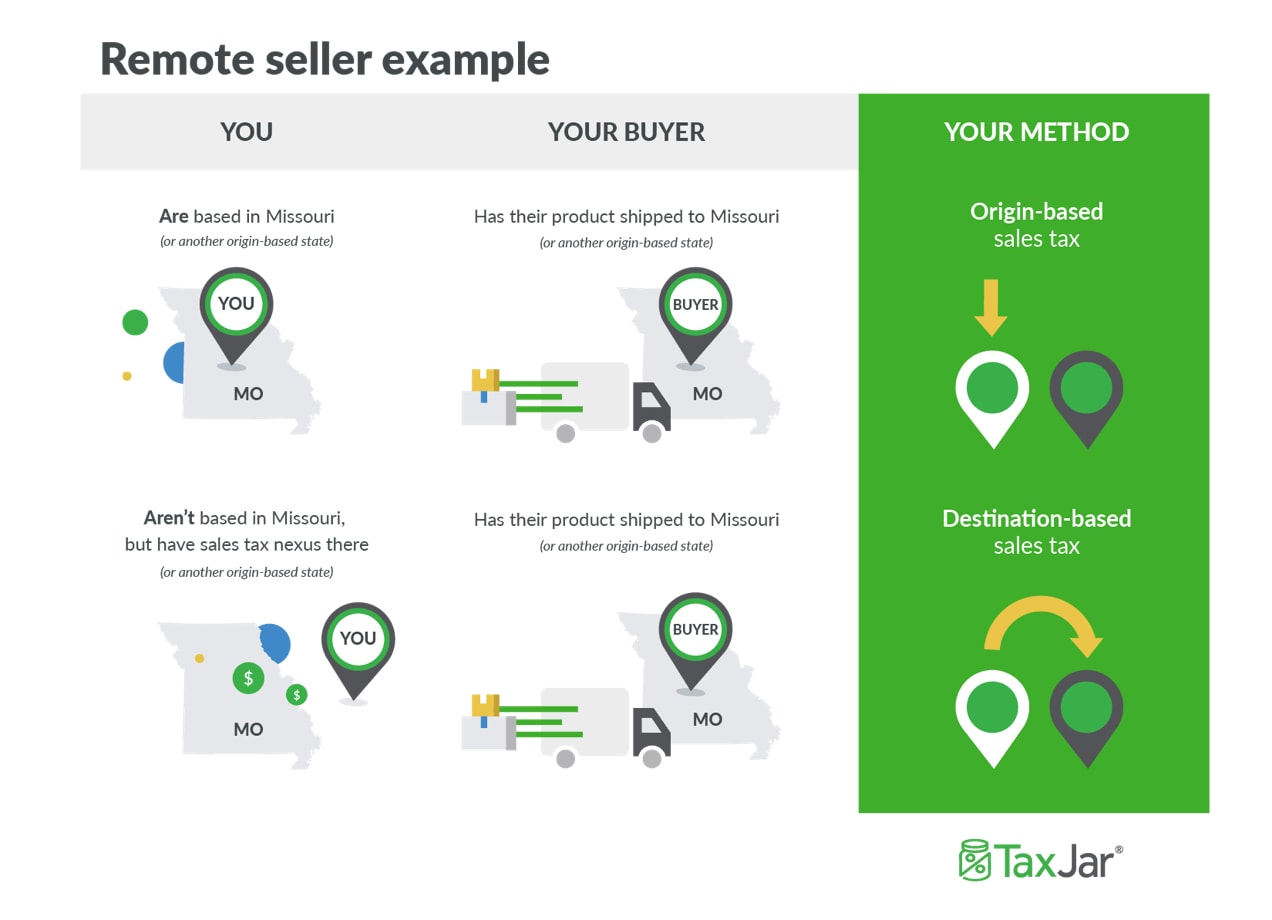

2 A state lodging tax is only levied in special statutory designated redevelopment districts at 50. North Carolina has a 475 statewide sales tax rate but also has 323 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2188 on top of the state tax. Providing resources tools and technical assistance to cities counties and local authorities to help strengthen communities.

You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202122. 200 per day per room the hotel room occupancy tax rate. Hotel and room rentals are taxed at 13.

Details of the personal income tax rates used in the 2022 North Carolina State Calculator are published. 3 State levied lodging tax varies. Did South Dakota v.

The tax as all other taxes was created as a way to increase government revenues.

How To Charge Your Customers The Correct Sales Tax Rates

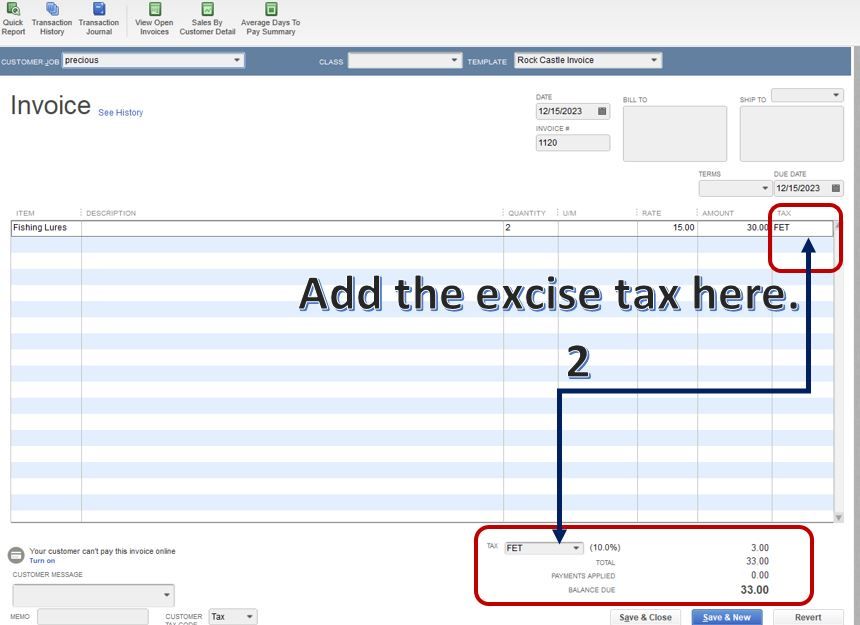

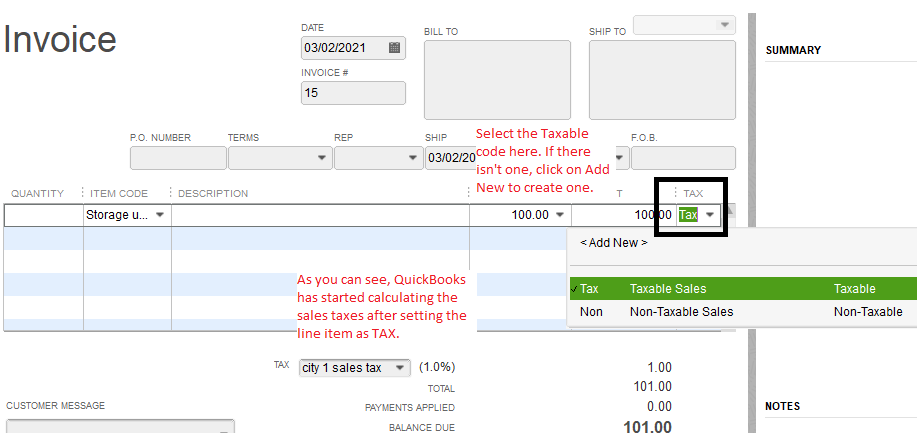

Solved How Do You Add Tax To Estimates And Invoices

Solving Sales Tax Applications Prealgebra

Home Depot Sales Tax On Tool Rental Home Depot Sales Home Tools Rental

Momaday And Brown Essay In 2021 Essay Essay Writing Essay Writing Tips

What Is The Difference Between Sales Tax And Use Tax Sales Tax Institute

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Fha Changes May Tighten Credit For Homebuyers Realestateagent Firsttimehomebuyer Massachusetts Massachusetts Association Of Buyer Agents Investing Financial Management Financial

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Invoice With Sales Tax Template Google Docs Google Sheets Excel Word Template Net Job Resume Template Invoice Template Invoice Design Template

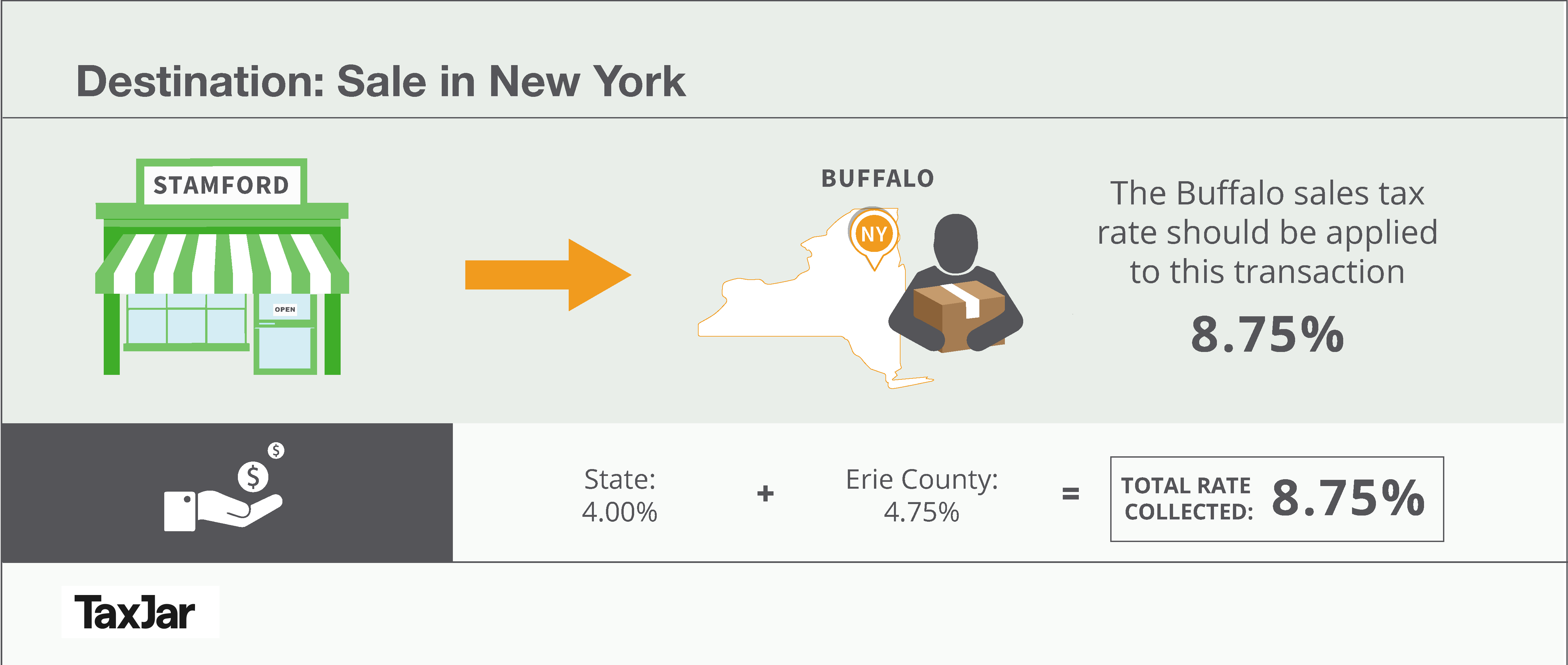

How To Charge Your Customers The Correct Sales Tax Rates

Solved How Do You Add Tax To Estimates And Invoices

Solving Sales Tax Applications Prealgebra

Tax Base Definition What Is A Tax Base Taxedu

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Marginal Tax Rate Formula Definition Investinganswers

Life For A Limited Time Only Limited 1 Per Person Subject To Change Without Notice Provided As Motivational Prints White Throw Pillows White Framed Art